To summarize last week’s price action, we would say it was kind of expected. Existing trends with grinding price action working to achieve their targets and a Friday stop loss frenzy to cap the week off. Now we could say that Friday’s price action was based on new Covid strain fears and what that could mean to global economies in the near future. However, FX market participants who were positioned correctly in advance, know when it’s time to take some profits and lighten up on positions to give the market a chance clear out the weaker positions. FX cross pairs will continue to be the driving force for how the base and reciprocal currencies react.

Euro Dollar, EUR/USD, reacted as expected last week trading directly into the projected dynamic support at 1.1185, while also becoming oversold on a daily basis, providing a unique opportunity to cover short positions. As the daily chart below shows, the oversold condition occurs after reaching the dynamic weekly support area.

Looking at the week ahead, 1.1310 will be important from a daily perspective and if we can get a daily close above here, look for further short squeezing up to 1.1390/00 which is where initial dynamic resistance appears. On the downside, 1.1220/10 is the initial dynamic support to pay attention to.

Sterling, GBP/USD, traded as expected with lower weekly price action and not as much of a bounce on Friday as EUR/GBP buying kept it at bay. Looking at this pair without knowing where EUR/GBP is headed is a huge disadvantage. As we mentioned in last week’s article, Sterling is still headed for 1.31, but how fast it arrives will depend on how the cross reacts. Looking at the daily chart below, .8540 becomes an important level that if we get a daily close above, could see the cross continue to rise.

For the coming week, we see initial dynamic resistance at 1.3410/20 and dynamic support at 1.3240/30.

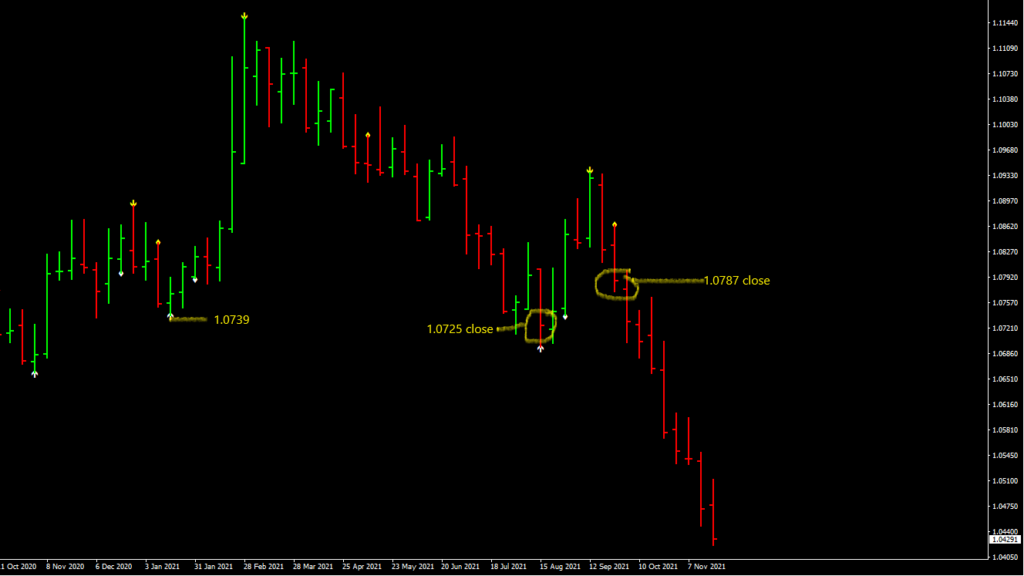

Dollar Swiss, USD/CHF, gave up some ground last week and saw a reversal in price action. Continued safe haven buying of the Swiss Franc vs the Euro and other pairs kept this pair from rallying further. When looking at USD/CHF in comparison to EUR/USD, we can see that both had the same reaction on Friday. However, when examining EUR/CHF, as the chart below shows, this has just been more of the same since the week of Sept 26th, where the pair closed at 1.0787.

For the coming week we see initial dynamic resistance for USD/CHF at .9260/70 and dynamic support at .9190/80. EUR/CHF is getting oversold on a weekly basis and traders should keep an eye on dynamic support in the 1.0385/75 area.

Dollar Yen, USD/JPY achieved our weekly target at 115.20 with highs of 115.50 last week before trading right into our dynamic support area of 113.00/10 and closing at 113.30. As we mentioned last week, we’re patiently waiting to see if the monthly chart can close above 114.55 to trigger the next leg higher. With month end occurring later this week, we will play this close to the vest. Look for dynamic resistance at 115.55/65 and dynamic support at 112.45/35.

Dollar Canada, USD/CAD provided a daily close above 1.2745 last week to give more confidence to the upside. As the chart below shows, this was not a new phenomenon, but began with the close the week of Oct 31st at 1.2450.

It should also be noted that last week EUR/CAD traded into the dynamic support area while EUR/USD did simultaneously providing a buying opportunity which helped to fuel USD/CAD higher. Look for initial dynamic resistance at 1.2895/05 and dynamic support at 1.2675/65.

Aussie dollar, AUD/USD continued it’s downward price action and broke below .7165, triggering stop losses. The sell off to .7110 and close near the low’s on Friday will be the focal point for this week. However, we are cautious as AUD/USD is approaching oversold condition and we would wait for a daily alignment to coincide with a weekly dynamic support area to lighten up any short positions. Look for initial dynamic support at .7025/15 and dynamic resistance at .7205/15.

Kiwi, NZD/USD had similar price action to it’s commonwealth neighbor, but with more vigor and close at it’s lowest levels since August. While we expect this move to continue lower still, just like the Aussie, we are approaching oversold condition and would wait for a daily/weekly dynamic support alignment to cover short positions for the time being and allow this pair to retrace for better selling opportunities. Look for initial dynamic support at .6710/00 and dynamic resistance at .6910/20.

Forex Forecasts Weekly - Dec 5th - Proven Trader

[…] by EUR/GBP in the short term and traders should be aware of key levels in the cross. As we mentioned last week, a daily close above .8540 in EUR/GBP would begin to change the short term outlook for this […]