Last week’s price action fell in line with our overall expectations. EUR/USD traded within it’s dynamic support and resistance levels. GBP/USD maintained it’s bearish posture, which coincided with the bid tone in EUR/GBP. USD/CHF was lead by EUR/CHF lower and closed right in the dynamic support area. USD/JPY failed to close the month above 114.55 triggering lower price action into the weekly dynamic support area before closing slightly above. USD/CAD maintained it’s upside momentum making new highs. AUD/USD and NZD/USD maintained their bearish price action and couldn’t find a daily weekly dynamic support alignment, both closing on the lows of the week.

Looking at the week ahead, EUR/USD does not have any key trend determinants which would shake our confidence in the lower overall targets. However, we still see this pair being driven by EUR/GBP in the short term and traders should be aware of key levels in the cross. As we mentioned last week, a daily close above .8540 in EUR/GBP would begin to change the short term outlook for this pair. Friday’s close at .8540 may be the first signal of this and if this is the case, a pullback to the .8470 level should be the starting point for long positions to accumulate. Look for initial dynamic resistance at 1.1355/65 and dynamic support at 1.1255/45. There is a weekly monthly dynamic support alignment which comes in at 1.1180/70 and traders should be weary of initiating any new shorts at these levels.

Sterling, GBP/USD, maintains it’s bearish posture and as pointed out above, is intermingled deeply within EUR/GBP. Also to mention is that GBP/USD is approaching oversold status on a weekly basis. In addition, a weekly/monthly alignment exists with initial dynamic support at 1.3155/45 level. Typically when we get multiple time frame overlays, we add an extra level of importance. Initial dynamic resistance appears at 1.3320/30.

USD/CHF while maintaining a modest weekly uptrend, is struggling to break up higher with the selling coming from EUR/CHF. As we pointed out last week, EUR/CHF is preventing dollar swiss from rallying, however, we are now approaching two consecutive weeks in oversold status which could signal this pair running out of steam in the short term. This could lead to the breakout that USD/CHF traders have been waiting for. Consolidation in dollar swiss has already triggered a monthly bias higher with a daily close last week above .9200 and a failure to close back below .9160. If this pair is able to maintain daily closes above .9160, it could be headed to .9425 before the end of the month.

Dollar Yen, USD/JPY, is attempting to break to the downside. It made four separate attempts at breaking below the prior confirmed low at 112.72, but has been unable to close below. As the chart below shows, we await the close below the key support area for further downside price action.

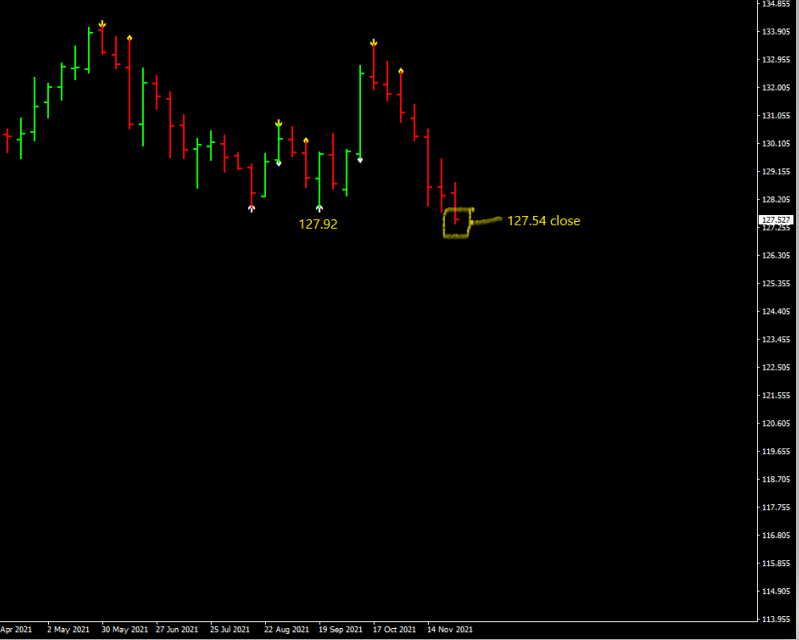

EUR/JPY also added an additional filter which should support a downwards bias. As the chart below shows, It broke and closed below the prior double bottom at 127.92 opening up further downside momentum.

USD/JPY Initial dynamic resistance appears at 113.15/25 and dynamic support at 112.45/35.

USD/CAD continues to gain momentum to the upside, with 1.2948 as the weekly level which changes the medium term outlook for this pair. We are cautious though as there is a weekly theme which appears for the commodity based pairs. For USD/CAD, it is approaching over bought status on a weekly basis and initial dynamic resistance appears at 1.2935/45 so we are apprehensive that the critical 1.2948 will see the close above this week. Look for initial dynamic support at 1.2740/30.

Aussie dollar, AUD/USD while following commodity markets closed at it’s low point on Friday near .6995/00. Downside momentum still prevails here, but a test this week near the initial dynamic support area of .6885/75 should be a stretch as we are approaching oversold territory. The important thing to consider here is that USD/CAD is overbought at the same time and we would expect that the moves happen simultaneously. Look for initial dynamic resistance at .7105/15.

Kiwi, NZD/USD is also being driven by the commodity based moves. It also is mirroring Aussie dollar movement step by step. With that said, we remain aligned with the Aussie logic and see the dynamic support area of .6645/35 limiting the downside initially and dynamic resistance appearing at .6840/50.

We would like to thank our readers for your support and wanted to let you know that in addition to the seven pairs we post about, we track a total of 28 currency pairs. The additional pairs are derivatives of the seven dollar majors and allows us to align forex crosses with their base pairs to uncover where the low hanging fruit stands out.

If you would like to receive updates on the cross pairs, please join our mailing list at https://proventrader.com

Forex Forecasts Weekly - EUR/USD, GBP/USD, USD/CHF, USD/JPY, USD/CAD, AUD/USD, NZD/USD - Proven Trader

[…] recap last week, commodity based currencies did most of the driving. As we pointed out, USD/CAD was overbought, while AUD/USD and NZD/USD were oversold, all at the same time. This had […]